capital gains tax canada calculator

All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year. ICalculator is packed with financial calculators which cover everything from income tax calculators to Personal and Business loan calculators.

Capital Gains Tax Calculator For Relative Value Investing

Completing your tax return.

. Free version available for simple returns only. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate.

If you sell an investment at a higher price than you paid youll have to add 50 of the capital gains to your income. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate. If an individuals total taxable income falls below 40400 by 2021 he or she will not have to pay capital gains taxes.

Capital assets subject to this tax include real estate land shares bonds and trust units according to the Canada Revenue Agency. The CRA says Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. If you sold your property in 2020 and it was your principal residence you must report the sale.

You do not need to include these documents with your income tax and benefit return as proof of any sale or purchase of capital property. If you sell qualifying shares of a Canadian business in 2022 the LCGE is 913630. How To Calculate Your Crypto Tax In Canada If your crypto disposal is treated as a capital gain half of your gain will be subject to tax.

Use the simple monthly Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the monthly income tax calculator 2022. Capital Gains 2021. The sale price minus your ACB is the capital gain that youll need to pay tax on.

For 2021 if you disposed of qualified small business corporation shares QSBCS you may be eligible for the 892218 lifetime capital gains exemption. The rate you will be charged for this gain will depend. Do not include any capital gains or losses in your business or property income even if you used the property for your business.

In our example you would have to include 1325 2650 x 50 in your income. Find out your tax brackets and how much Federal and Provincial taxes you will pay. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses.

The amount of capital gains to pay is reduced by 15 percent if 40401 to 445850 is their income. You can calculate your Monthly take home pay based of your Monthly Capital Gains Tax Calculator and gross income. Your tax rate is 0 on long-term capital gains if.

Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital gain at line 12700 on his. For instance if you sell a property and make 100000 in profit the capital gains tax rate will only apply to 50000. What Is The 2021 Capital Gains Tax Rate.

Since its more than your ACB you have a capital gain. In Canada 50 of the value of any capital gains is taxable. Those with a higher income level are subject to a 20 percent tax rate.

Business or inherited properties. The Canadian Monthly Capital Gains Tax Calculator is updated for the 202223 tax year. The inclusion rate of capital gains in Canada is 50In the case of capital gains made when an investor exceeds his or her down payment for a capital property the Canada Revenue Agency CRA imposes a tax on half 50 of the down paymentIf you earn a gain of 50 it can be taxed at your marginal rate of 20.

In Canada 50 of the value of any capital gains is taxable. Instead capital gains are taxed at your personal income tax rate. There is no special capital gains tax in Canada.

Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Your sale price 3950- your ACB 13002650. For more information see Completing Schedule 3.

You realize a capital gain if you sell a capital asset and the proceeds of the sale exceed the adjusted cost base. Mario calculates his capital gain as follows. Plots of land larger than 5000 square meters.

Capital gains are profits made from the sale of an investment like a stock or bond. In Canada capital gains tax is applied to 50 of the profit you made. You will need information from your records or supporting documents to calculate your capital gains or capital losses for the year.

Our online calculators are designed to make it. Adjusted cost base plus outlays and expenses on disposition. However as only half of the realized capital gains is taxable the deduction limit is in fact 456815.

However the calculator assumes that only the basic personal tax credit as well as the dividend tax credit and Canada. You may have to pay Capital Gains tax if you own a single property and use part of it for business purposes such as a home office or letting a room out. 6500 - 4000 60 2440.

Capital gains tax rates are dependent on the. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. Capital gains taxes are progressive similar to income taxes.

Capital Gains tax on property sales mainly applies to. Only 50 of your capital gains are. Calculate and report your crypto tax for free now.

Canada Capital Gains Tax Calculator 2022

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Calculator For Relative Value Investing

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

The Best Financial Certifications To Pursue In 2020 Estate Tax Capital Gains Tax Money Market

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Taxtips Ca 2017 Canadian Income Tax And Rrsp Savings Calculator

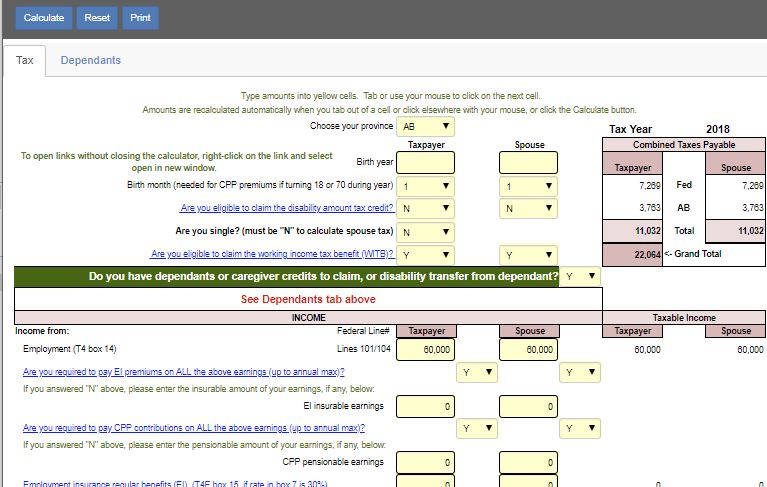

Taxtips Ca 2018 Canadian Income Tax And Rrsp Savings Calculator

Capital Gains Tax Calculator 2022 Casaplorer

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services